Crowdinvestments

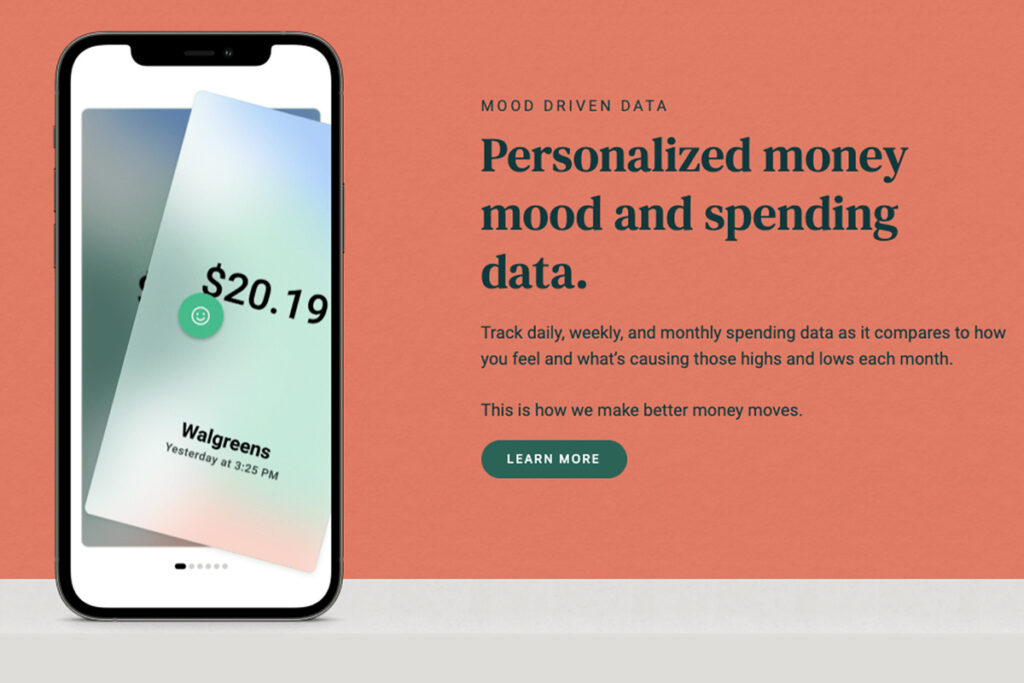

Nav.it financial health app

Location:

Seattle, WA, US.

Nav.it

- Nav.it

- Crowdfunding

- Date: October 2022

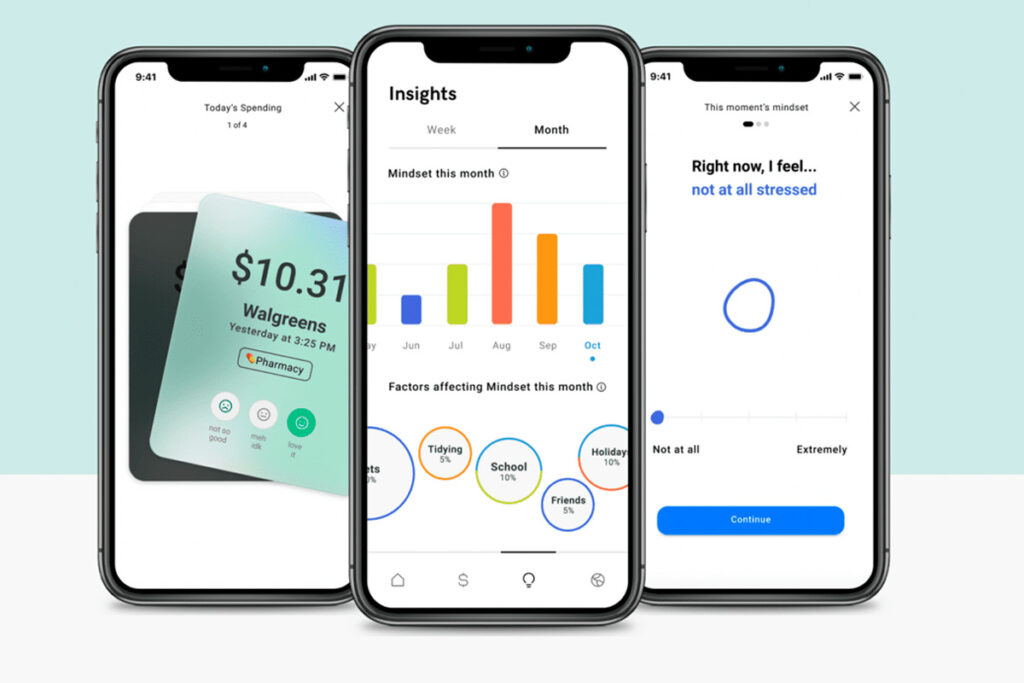

The financial health app helping everyone build a future of wealth + health

About Nav.it

Where wealth meets health

We’re more than just a money app

Nav.it focuses on your habits and stress levels to improve behavior alongside a community of peers striving for financial wellness.

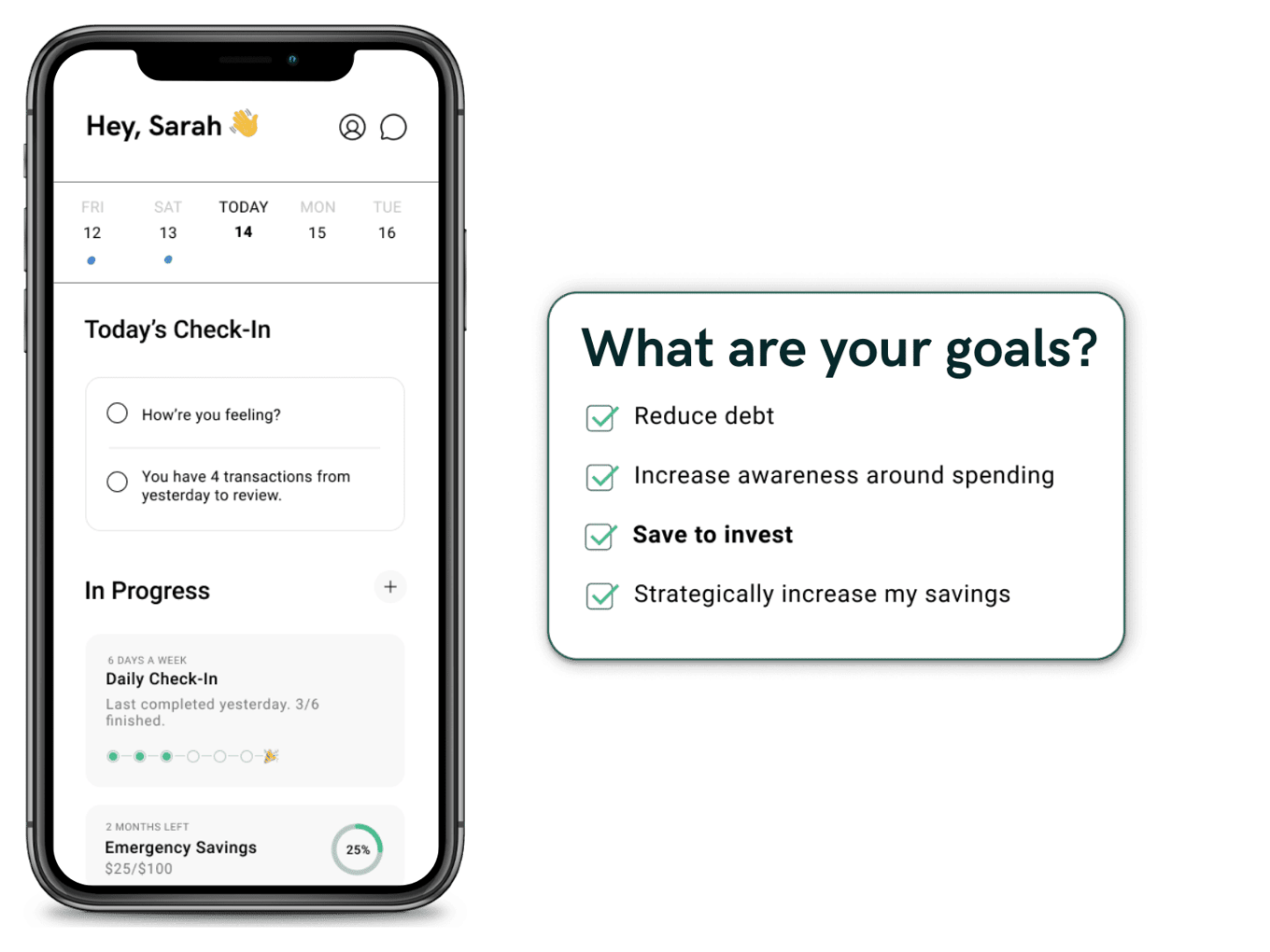

Step 1. Define your goals.

Navigators “get to know themselves” through a proprietary personality test that helps them identify their values, spending personas, and big picture goals.

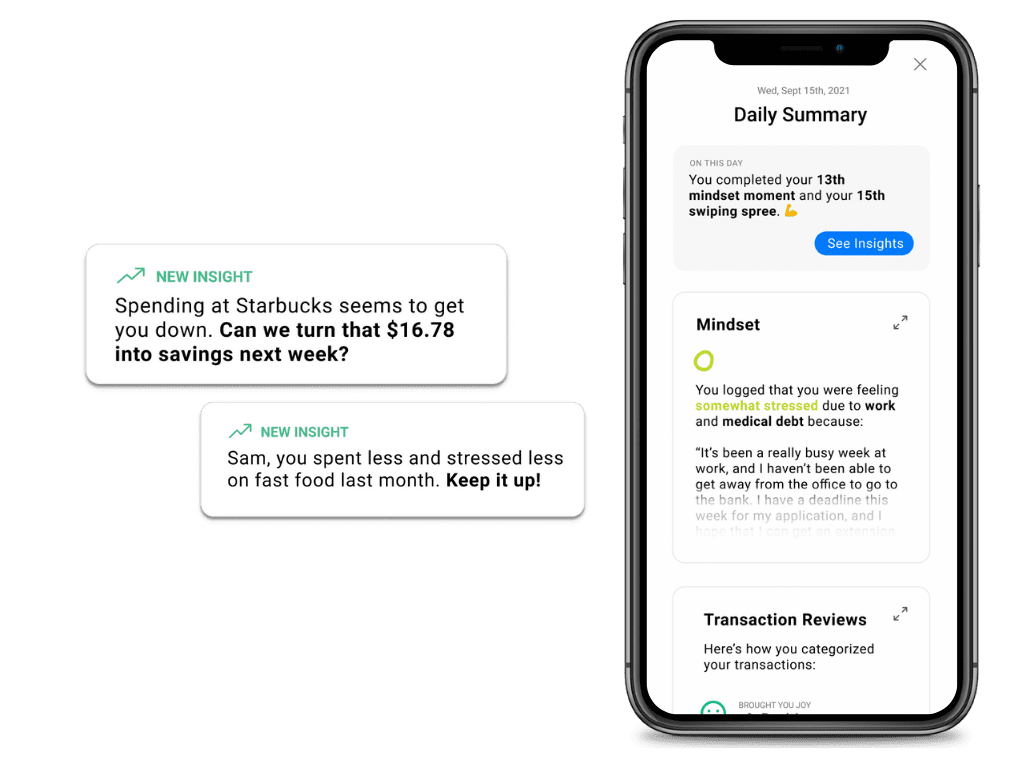

Step 2. Identify existing behaviors.

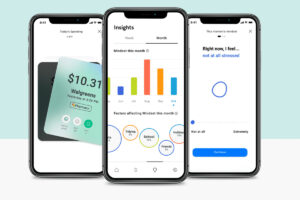

Navigators track their money habits by logging their moods and ‘swiping left or right’ on their expenses daily. We then surface unique insights to correlate behavioral and financial trends over time.

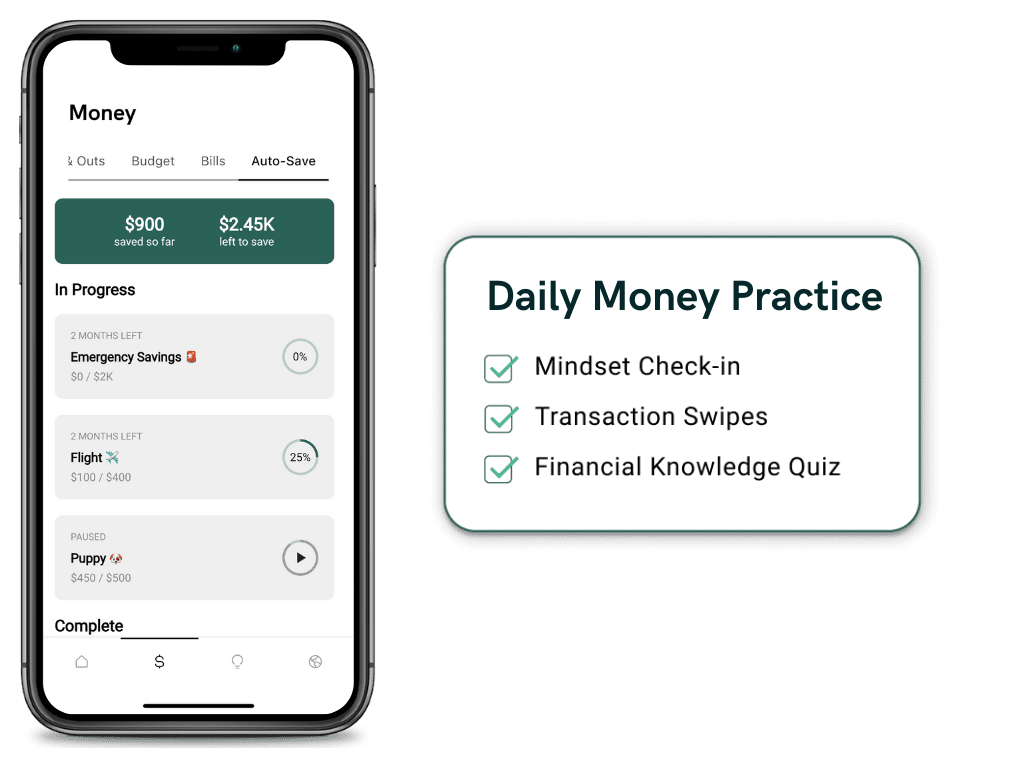

Step 3. Build a financial roadmap.

Insights help Navigators set up micro spending and savings goals. They can engage with others on their journey and even choose one-on-one coaching for extra support.

We are currently designing a tailored, modular roadmap based on incremental financial habit changes that result in long-term gains over time.

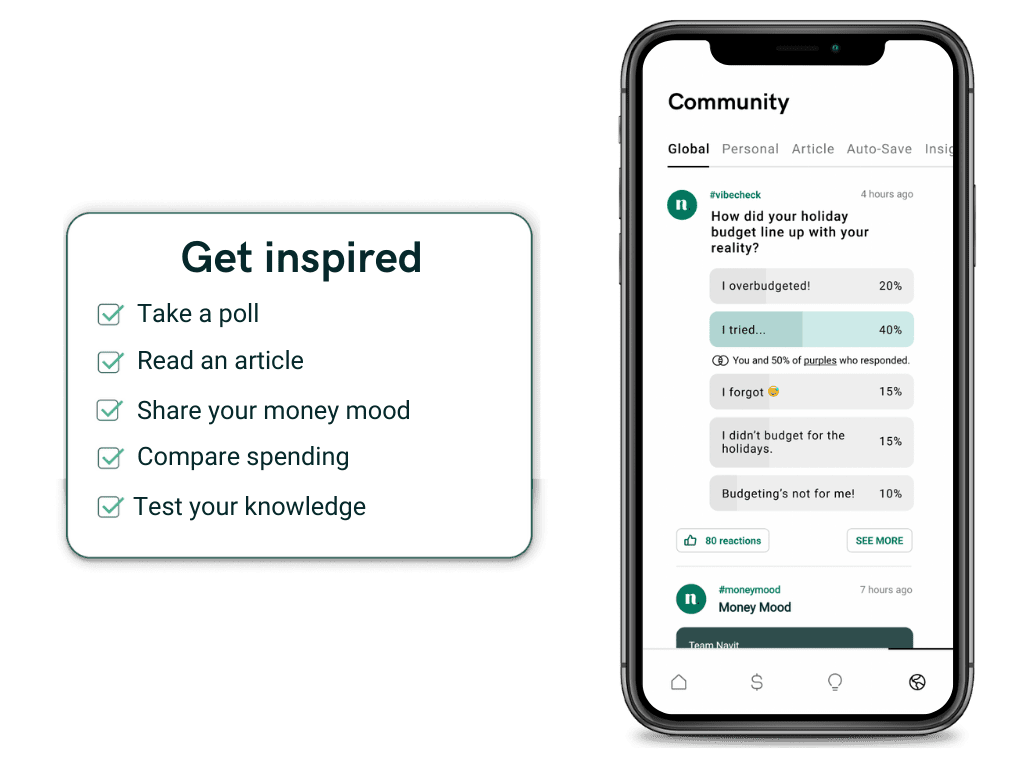

Step 4. It’s okay to talk about money.

A sense of belonging increases confidence. We’re building a financial social network that encourages positive behavior and rejects the reinforced superficiality of other social networks.

We’ll foster open conversations about money, support healthy small group interactions, and help Navigators connect to others.

Highlights

Highlights

- Founded by a behavioral scientist

- Automated coaching based on proprietary AI

- Identifies money habits, personalities, and potential risks

- Targeting young earners and Zillennials

- Leveraging strategic, affiliate, and employee partnerships

- 50,000+ Navigators, 1 employer pilot, 2 distribution pilots

- Featured in Forbes, Bloomberg, Medium, USA Today, Yahoo! Finance

ANGEL INVESTMENTS

CROWDINVESTMENTS

Instafloss

Edible Garden Zero-Waste Inspired Farming

Iris Social Investing

Unbanked global bank account

ALL3D Virtual products and storefronts

Nav.it financial health app

Danelfin AI-Powered Stock Picking

Artfinder discover art by independent artists

Steven mobile group payments

Mayku Industrial parts in minutes

Trending Travel

Pawprint Achieve net zero faster

Crosspay turn-key payment solutions

Genuine Impact Research stocks in 2 minutes

Mintos Marketplace for Investing in Loans

NGX Personalised Meal Shakes to your DNA

Phlo Digital Pharmacy

Wirex unique UK fintech that aims to make all currencies equal

BNC 10 Spanish neobank

Common Objective B2B Sourcing Platform of Sustainable Businesses

Immersionn 3D Virtual Worlds

Atterly marketplace for independent fashion retailers

Autolease Compare transforming the growing UK car leasing industry

Transinet the world’s first crypto proof-of-ownership registry

Oracle Health

InnaMed – At-home blood testing technology

Cava Health – Health tracking redefined

RX Delivered Now

ePOS Hybrid – Point of Sale Software

CoinBurp

Bnext

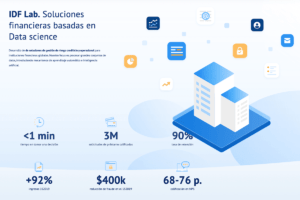

ID Finance

Arrival Bank

Curve – 100 Cards in One