Crowdinvestments

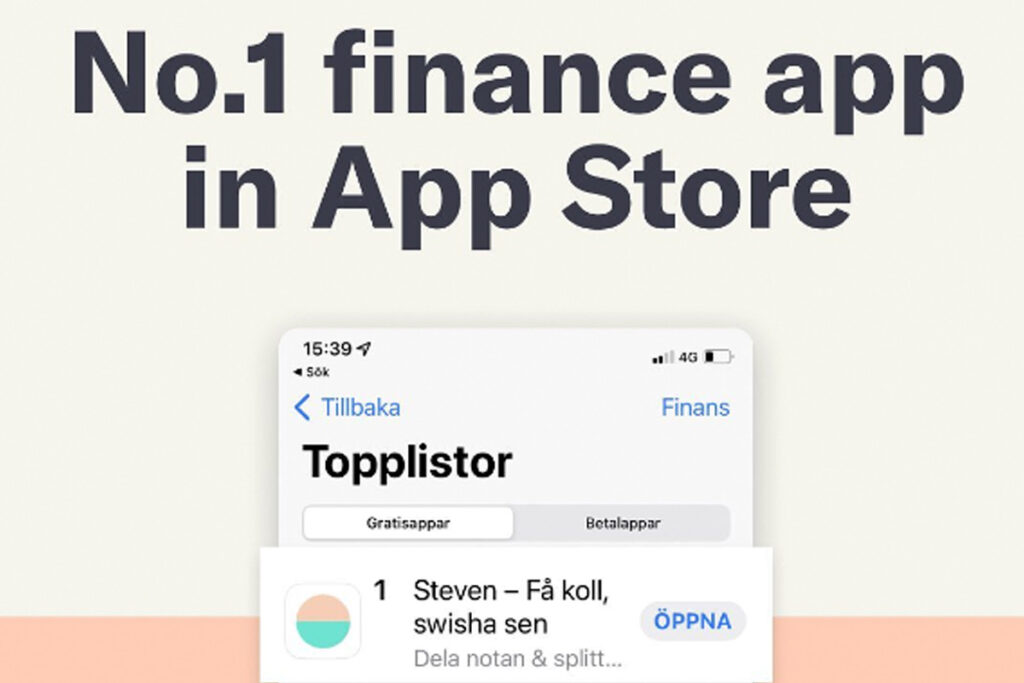

Steven mobile group payments

Location:

Stockholm, Sweden.

About Steven

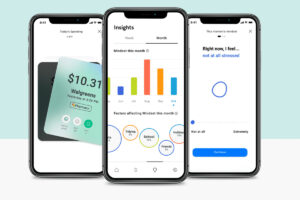

Doing things we love with people we love is what it’s all about. But settling the expenses afterwards can easily get awkward. Steven is the finance wiz at your fingertips who removes the hassle of sorting out group payments.

And our finances gets more and more intertwined with other people. To monitor our personal balance, we must also keep track of shared expenses and Steven solves just that!

In contrast to most financial players, who gain users via marketing, Steven has reached 165,000+ users in Sweden across 3.5 years almost exclusively organically, showing an actual demand. In 2022 the speed of growth has increased, and we’re on a mission to be 250,000+ users at the end of 2022, and plan to expand to further markets.

Currently, users share over 100,000 expenses in Steven per month. It can be expenses for travelling, household expenses and everything in between.

To make it easier than ever to add expenses, Steven has just launched a card in co-op with Mastercard. Anything you buy with the card is automatically added to the app, reducing the number of steps needed to add an expense. The card increases the stickiness even further and is also Steven’s first step to monetise the userbase.

With expense sharing, connected bank accounts, and now a payment card, Steven is striving to be the platform where users can completely control their finances, instantly.

ANGEL INVESTMENTS

CROWDINVESTMENTS

Instafloss

Edible Garden Zero-Waste Inspired Farming

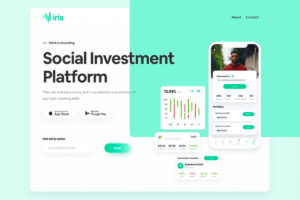

Iris Social Investing

Unbanked global bank account

ALL3D Virtual products and storefronts

Nav.it financial health app

Danelfin AI-Powered Stock Picking

Artfinder discover art by independent artists

Steven mobile group payments

Mayku Industrial parts in minutes

Trending Travel

Pawprint Achieve net zero faster

Crosspay turn-key payment solutions

Genuine Impact Research stocks in 2 minutes

Mintos Marketplace for Investing in Loans

NGX Personalised Meal Shakes to your DNA

Phlo Digital Pharmacy

Wirex unique UK fintech that aims to make all currencies equal

BNC 10 Spanish neobank

Common Objective B2B Sourcing Platform of Sustainable Businesses

Immersionn 3D Virtual Worlds

Atterly marketplace for independent fashion retailers

Autolease Compare transforming the growing UK car leasing industry

Transinet the world’s first crypto proof-of-ownership registry

Oracle Health

InnaMed – At-home blood testing technology

Cava Health – Health tracking redefined

RX Delivered Now

ePOS Hybrid – Point of Sale Software

CoinBurp

Bnext

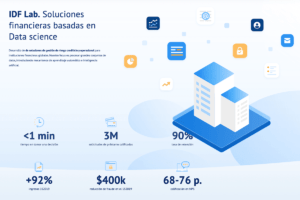

ID Finance

Arrival Bank

Curve – 100 Cards in One